Chapter 2 Money & Banking

2.1 Money, Debt, & Credit

Money is an abstract concept, closely linked to the notions of wealth, income, credit, and debt. While most people closely associate money with paper currency issued by governments, it is a much broader social and political construct. As a social construct, money functions as it does—facilitating exchange, measuring value, and storing value—because people agree that it exists. As a political construct, states authorize their money for the payment of taxes and require it to be accepted in payment for debts. In this sense, nations can be considered as the protectors of the debts between occupants of politically delineated boundaries. Money serves several functions. It is a medium of exchange; a unit of account; and a store of value. Money is also a standard of deferred payment.

As a medium of exchange money is not the thing that is consumed in the process of trade but rather a symbol of agreed upon value. When a person sells their time to an employer, they are usually paid in money and not tangible consumption goods. The purpose of money in this instance is for the worker to ultimately use it in the future for their own consumption. Thus, there is an implicit agreement upon the value of the goods being exchanged (e.g., labor for time). Money also serves as a unit of account; in that it is how value is measured. In this way, money serves as standard of measurement. Thus, value of objects or actions can be measured and compared to one another. This is much the same as measuring height, weight, or speed. To serve as a store of value, money must retain most of its value over time. If one knew that money had no value at some point in the future, there would be no reason to accept it for exchange today. The store of value represents in some ways the trust that we place in one another when exchanging real things with each other over time.1 Currency issuing nations mandate the terms of payment of taxes, as well as the repayment of debts between a state and its people. Money also serves as a standard of deferred payment. A deferred payment happens when the time of purchase occurs separately from the time of payment. Money serves as the standard with which we value these payments (or debts). Since money represents a standard in inter-temporal commitment (e.g., goods or services are consumed today, but paid for next year), it serves as the object through which our debts and credits are settled with a state or in private transaction.

Money can be used to measure both stock and flow variables. Stock variables—like wealth—are measured at a given point in time. Below, balance sheets represent a typical way of measuring wealth (i.e., net worth) for individuals or capital (i.e., net equity) for companies. Flow variables—like income—are measured over a set length of time. Income might be paid as $1,000 per week, or $50,000 per year. Cash flow or income statements are common ways of measuring flow variables.

Debt is a stock concept, representing the sum of obligations owed to others at a given point in time. For example, you might have $1,200 in accumulated debt at one point in time. Deficits or surpluses are flow concepts represented as the difference between income and expenditures over a set length of time. If you have $500 a week in income, and $600 in expenses, the result is a $100 per-week deficit. In this example, after one week, debt would rise from $1,200 to $1,300 as the $100 deficit is realized. Debts are the accumulated sum of all previous deficits and surpluses. It should be noted that debts do not need to be denominated in terms of an official state-issued currency. You could be in debt to a friend to “give a ride,” “move a couch” or “buy a drink” without resorting to dollars or contracts. However, in the U.S., debt is generally measured in dollars. Debt is often inappropriately vilified, when the true concern might be that a person or entity has taken on too much debt. It might be better to think of debts as symbolizing promises of future real activity. It is common that some person or entity takes on more future real obligations than they might be able to deliver. In this case, when the time comes to collect on an earlier promise which cannot be fulfilled, both the debtor and creditor might renegotiate the terms of repayment.2 In most circumstances, debts are repaid. In this way, debt represents the social and community ties that take place over time. It is worth noting that whenever there is a delay in completing a transaction, debts are created. It is nearly impossible to think of a world in which debt does not exist or one where it is outlawed. Hence, debt and money represent a special kind of social contract.

As is explained below, people and banks can create money out of thin air. Today, when an obligation which spans time is entered into between two parties, this debt is measured using money. In this way, a $10 bill represents future real activity that someone will do for you. Cash, somewhat counterintuitively, is a symbol of debt. If you read a U.S. Federal Reserve Note (U.S. paper money) it says on the front, that “This note is legal tender for all debts, public and private.” To the person holding physical or electronic cash, it means either you can repay your debts with it, or you can unlock real activity from someone else by getting them to do something for you. A wealthy individual—like Mark Zuckerberg—holds a great deal of influence over what other people will be doing in the future.

2.2 Wealth and Balance Sheets

With the concepts of money, debt, and credit introduced, an example can be developed. Imagine that Logan owns several assets. Let’s say he has $1,000 in a checking account, $60 in cash, a computer he values at $800, a phone valued at $500, and a bike worth $300. These values are what he thinks he can sell these to someone else for. We measure the object’s liquidity as the speed you can turn an asset into cash, without significant loss in value. Cash and deposits are generally the most liquid assets, since there is minimal risk that it is not worth exactly what you think it is (e.g., $100 can be sold for $100). However, a computer, phone, or bike might not sell right away (or ever) at the values you estimate.

We then examine Logan’s liabilities, or obligations to others. If he owes $1,000 to his credit card company, and has $3,000 in student loans, he has promised to repay those amounts—likely with interest—at some point in the future. We define wealth as the difference between your total asset value and total liabilities. This difference is called wealth or net worth for individuals and capital or net equity for firms and banks. A balance sheet equates total asset value (usually shown on the left-hand side) with total liabilities plus net worth (usually both shown on the right-hand side).

\[ \text{Assets}=\text{Liabilities}+\text{Net Worth}\]

Using these values for the things Logan owns ($2,660) and debts he owes to others ($4,000), he would have a net worth of -$1,340. We need to emphasize that net worth is the item on our balance sheet that balances the right-hand and left-hand side of Table 2.1.

| Cash | $60 | Credit Card | $1,000 |

| Deposits | $1,000 | Student Loan | $3,000 |

| Computer | $800 | ||

| Phone | $500 | ||

| Bike | $300 | Net Worth | -$1,340 |

| Total | $2,660 | Total | $2,660 |

Having negative wealth does not mean Logan is bankrupt, but it does mean he could not liquidate his assets and fully repay his debts. He might be in this situation because he is borrowing money to get an education, investing in his own human capital. He might do this because he expects this human capital investment will pay for itself through additional future earnings, earnings that exceed the amount being borrowed today. Recall, it is only when real promises are unfulfillable that borrowers are in danger of declaring bankruptcy. This arrangement—borrowing money to go to school—is usually a good deal for both the borrower and the lender.

To understand bankruptcy, Logan’s cash flow must be considered, as it will show how his wealth is changing over time. Let’s assume Logan has an income of $2,000 per month, with rent of $800 per month, interest payments of $50 per month, and other expenses (electricity, cell phone, food, and interest costs on his debt) of $1,000 per month.3 This leaves a surplus of $150, which we will assume Logan uses $50 to pay down his credit card debt, $50 to pay down his student loan debt, and keeps $50 to add to his checking account.4 We write out all the changes to the balance sheet in what is called a T-account which is used to keep track of all the transactions in Table 2.2.5 Notice that the entire $150 set aside by Logan to repay debt and increase his checking account balance goes towards increasing his net worth. Some of this occurs through adding to his assets, and some occurs through reducing his liabilities.

| Deposits | $50 | Credit Card | -$50 |

| Student Loan | -$50 | ||

| Net Worth | $150 | ||

| Total | $50 | Total | $50 |

Our new balance sheet for Logan is visible in Table 2.3, where we can see the changes from our previous balance sheet as described in our T-account.

| Cash | $60 | Credit Card | $950 |

| Deposits | $1,050 | Student Loan | $2,950 |

| Computer | $800 | ||

| Phone | $500 | ||

| Bike | $300 | Net Worth | -$1,190 |

| Total | $2,710 | Total | $2,710 |

2.3 Banks and Money Creation

Banks can be described using balance sheets and T-accounts in much the same way as we described Logan’s personal finances before. Banks are different though in that they are profit-seeking institutions, looking to make money for their investors (i.e., equity holders or shareholders). Interest payments are one form of income for banks, which can lead to bank profits. Banks can also make other profitable investments, such as by buying assets that can be sold for more money than they were purchased for. Interest payments and interest rates are normally described in nominal terms. Nominal here just reflects how much more money needs to be repaid in the future and does not dictate how much in additional real goods and services are paid by the borrower. Above, we combined interest payments with all other expenses. A person like Logan who owes $3,000 to a bank for his student loans, with an 11% annual interest rate, repaid over four years would have to make regular monthly payments of $77.50, where at first the principal repayment is $50 and the remaining $27.50 is interest.6 Over the course of the loan, Logan pays $3,722, which is $722 in interest, on top of the $3,000 of principal. At no point does Logan make a big $3,000 payment, but he instead makes many smaller monthly payments. The same type of calculation would be used for his monthly credit card payments.

Businesses like banks start with capital (i.e., equity or net worth). We start with a group of investors who are opening Jupiter Bank. The owners want to pool some of their financial resources to incorporate as a bank and make a profit. Let’s imagine a group of 50 investors who each contribute a $1,000 cash investment, for a total of $50,000 as in Table 2.4. The bank starts with a pool of $50,000 cash.

| Cash | $50,000 | ||

| Capital | $50,000 | ||

| Total | $50,000 | Total | $50,000 |

As investors, we might think that a big pile of cash is not going generate much of a return. We would be right. If prices rise over time due to inflation, the investors’ money buys fewer real goods each year. Investors want their assets to grow over time so that they have greater wealth and can buy more real goods. Thus, the bank owners decide to hire managers who will take some calculated risks on their behalf. To operate as a bank, depositors are needed, and loans would be made. To attract business from people like Logan, the newly founded bank might offer higher interest rates on their deposits than other banks. Let’s suppose they offer a 1% annual return on deposits to Logan, along with a host of other benefits like debit cards, and online banking.

Logan’s deposit is a liability to Jupiter, as the bank now owes money to its depositor, Logan. The changes are reflected in a T-account (Table 2.5) and the new balance sheet (Table 2.5).

| Cash | $1,050 | ||

| Deposits | $1,050 | ||

| Total | $1,050 | Total | $1,050 |

| Cash | $51,050 | Deposits | $1,050 |

| Capital | $50,000 | ||

| Total | $51,050 | Total | $51,050 |

2.4 Reserves

At this point, we will take a closer look at the assets held by Jupiter and give them a new name. What Jupiter had on hand as “cash” is called “reserves” in banking terminology. The cash is still there, it just has a different name. Banking regulators—like the Federal Reserve in the U.S.—had until recently set up reserve requirements which determine a percentage of deposits that must be held at the bank in the form of cash or on their account with the Fed. Reserve requirements apply only to deposit accounts, and in the U.S. system banks must maintain a percentage of deposits—on average—over a two-week maintenance period. Since the 1980s, the reserve requirement in the U.S. was technically 10% for most accounts. Once the COVID-19 crisis took hold though, the reserve requirement was lowered to 0%, making it such that banks would only hold the amount of reserves they felt necessary.

Banks thus hold excess reserves which are just the amount greater than what they are required to hold.7 Both required and excess reserves are the primary source of liquidity in the banking system. When banks need to meet withdrawals or move money around to other banks, they do it with reserves. Banks generally hold some reserves in the form of vault cash, which is physical currency stored in the bank. Other reserve funds are held electronically on the bank’s reserve account with the Fed. The Fed acts as a “bank for banks” helping banks transfer money between each other, and they can create reserves out of thin air using a computer keystroke. As is shown below, reserves move with transactions and banks will often borrow them from each other for various reasons. The reserve requirement for this banking system is set at 0%. With this reserve requirement, the balance sheet can be rewritten, as in Table 2.7. Beginning in October 2008 U.S. banks have been paid interest on their reserve balances. In early 2020, the interest rate on reserves was as high as 1.6% annually, but was lowered to 0.1% in late March 2020.8 So, with this interest earned on reserves Jupiter Bank is currently getting a positive monthly cash flow simply from offering deposit services to their customers and storing reserve balances. Note, if the Fed were to increase this interest rate, banks would likely want to increase the interest rate that they were charging all their customers who borrow money.

| Required Reserves | $0 | Deposits | $1,050 |

| Excess Reserves | $51,050 | Capital | $50,000 |

| Total | $51,050 | Total | $51,050 |

At this point, Jupiter Bank’s managers decide to purchase some U.S. government bonds (i.e., Treasuries). The return on U.S. Treasuries is low compared to other assets, reflecting the fact that there is very little risk that they will not be repaid. Typically, Treasuries pay a higher interest rate compared to the interest on reserve rate, so here we will assume a 3% annual return. This higher interest rate is appealing to the bank since it would create more profits for our shareholders. There is also a very liquid market for Treasuries, and it is easy to turn them into cash quickly. Treasuries are also a good source of collateral—an asset pledged by a borrower to a lender, which can be taken and sold if the borrower cannot repay their loan. Good collateral might come in handy if this bank needs to borrow cash. In Table 2.8, we show that Jupiter takes $20,000 of its cash (i.e., reserves) and uses it to buy some government bonds. These changes are represented in the new balance sheet (Table 2.9).

| Excess Reserves | -$20,000 | ||

| Securities | $20,000 | ||

| Total | $0 | Total | $0 |

| Required Reserves | $0 | Deposits | $1,050 |

| Excess Reserves | $31,050 | ||

| Securities | $20,000 | Capital | $50,000 |

| Total | $51,050 | Total | $51,050 |

Starting from Table 2.9, Jupiter’s managers want to make some loans. The interest and fees on the loans made will allow them to pay interest to depositors, finance their operations, and create a profit for the shareholders. Let’s assume a potential customer named Olivia wants to borrow $20,000 to finance a new climbing gym she plans to open. She is willing to borrow the money at an interest rate of 8%, meaning she would pay about $1,600 in interest in the first year. When they make her this loan, the bank deposits the funds into an account for her at Jupiter bank so that she can use the money later, paying her the same 1% rate of return on her deposits that was paid to Logan. Jupiter creates a loan to Olivia, and this transaction is reflected in Table 2.10. Notice the process involves turning reserves into a loan. While somewhat unrealistic, we might imagine this is like Jupiter taking $20,000 cash from the vault and giving it to Olivia, who promises to repay $20,000 with interest. She then takes the cash to the teller who takes it and credits her deposit account. Now, think of the deposit as a new transaction. Since the bank is not required to hold any reserves, all $20,000 that Olivia deposits is considered excess reserves. A more realistic example would be to imagine electronic claims to money moving back and forth instead of paper money. In this case, Jupiter might never have even had the cash on hand.

| Excess Reserves | -$20,000 | ||

| Loan | $20,000 | ||

| Deposits | $20,000 | ||

| Excess Reserves | $20,000 | ||

| Total | $20,000 | Total | $20,000 |

Jupiter’s new balance sheet in Table 2.11 has increased by $20,000 on both sides, just as the T-account described. Note that the bank makes money and loans out of thin air. The loan is an asset to the bank, and while there is a risk that Olivia will not repay, the bankers are willing to take this risk in order to make a profit. On the opposite side of the balance sheet, the deposits Jupiter created are a liability to the bank. Earning a profit relies upon Olivia fulfilling her end of the deal and doing the real work in the future necessary to repay her loan and interest.

Now, imagine that Olivia takes $1,000 and uses her debit card connected to her deposit account to buy materials for her gym. This moves money out of her deposit account, and a corresponding amount of reserves must go with it. Note, that with the $1,000 being moved out of the bank, the $1,000 of excess reserves fall as well.

| Required Reserves | $0 | Deposits | $21,050 |

| Excess Reserves | $31,050 | ||

| Securities | $20,000 | ||

| Loans | $20,000 | Capital | $50,000 |

| Total | $71,050 | Total | $71,050 |

| Deposits | -$1,000 | ||

| Excess Reserves | -$1,000 | ||

| Total | -$1,000 | Total | -$1,000 |

| Required Reserves | $0 | Deposits | $20,050 |

| Excess Reserves | $30,050 | ||

| Securities | $20,000 | ||

| Loans | $20,000 | Capital | $50,000 |

| Total | $70,050 | Total | $70,050 |

2.5 Capital Requirements and Lending

Banks make loans to create profit and pay for the expenses of running their business. Below, we describe why regulators like the Federal Reserve in the U.S. want to ensure that banks have enough capital on hand if some of the banks risky investments do not pan out. The Federal Reserve does this using capital requirements which mandates banks to have a capital ratio that is at least a certain percentage of risky loans. Capital ratios are complicated in practice, but for illustrative purposes we set the capital requirement at 10% of loans. In Table 2.13, the total amount of loans is $20,000, and 10% of this would be $2,000. The bank, with $50,000 in capital is well above the $2,000 requirement. Jupiter’s managers are free to make more loans if they wish. They are also meeting their reserve requirement in Table 2.13 with $30,050 in reserves for $20,050 in deposits. With deposits of $20,050, they are required to have $0 in reserves, but they are holding some anyways in the form of excess reserves.

Both the reserve and capital ratio requirements are important in practice. The reserve requirement used to exist to ensure that banks have enough liquidity to meet withdrawals. While capital requirements exist to ensure that banks remain solvent in the event of losses. An insolvent bank would be one who could not liquidate all their assets and repay their liabilities.

Let’s imagine that Jupiter makes a new $40,000 loan to Emma who wants to start a cupcake shop. Emma plans to redeposit this loan in the bank, and like Olivia is also willing to pay an 8% interest rate on this loan. At the moment the loan is made, the bank does not have enough in excess reserves (since $30,050 < $40,000) and making the loan would leave them with only a portion of the reserves they are required to have. However, because Emma redeposits the money at Jupiter, there is no shortfall in required reserves. You should notice that in this situation, the total amount of reserves between Table 2.13 and 2.15 is unchanged. In the next section, we discuss what happens if Emma were to write a large check using the newly created deposits just placed in her account.

| Excess Reserves | -$40,000 | ||

| Loan | $40,000 | ||

| Deposits | $40,000 | ||

| Excess Reserves | $40,000 | ||

| Total | $40,000 | Total | $40,000 |

| Required Reserves | $0 | Deposits | $50,050 |

| Excess Reserves | $30,050 | ||

| Securities | $20,000 | ||

| Loans | $60,000 | Capital | $50,000 |

| Total | $110,050 | Total | $110,050 |

2.6 Fed Funds Loans

Let’s suppose that Emma wants to hire Cupcake Startup Inc. to help her get a cupcake shop up and running. Emma writes a check for $40,000 on her account, paid to Cupcake Startup Inc., who has an account at a different bank (Europa Bank in Table 2.17). When Emma pays Cupcake Startup Inc., money is transferred from one bank to another. Europa Bank’s reserves and deposits increase by the amount that they fall at Jupiter Bank.

| Deposits | -$40,000 | ||

| Excess Reserves | -$40,000 | ||

| Total | -$40,000 | Total | -$40,000 |

Now, a question is whether Jupiter is still meeting its reserve requirements. In Table 2.18, because of the changes described in Table 2.16, excess reserves are negative. Negative excess reserves indicate a shortfall in reserves. In this case, it can be viewed as total reserves being -$9,950, with a shortfall of reserves of $9,950. What should the bank do, given that they are short of their liquidity requirement?

| Deposits | $40,000 | ||

| Excess Reserves | $40,000 | ||

| Total | $40,000 | Total | $40,000 |

| Required Reserves | $0 | Deposits | $10,050 |

| Excess Reserves | -$9,950 | ||

| Securities | $20,000 | ||

| Loans | $50,000 | Capital | $50,000 |

| Total | $60,050 | Total | $60,050 |

Jupiter could choose to borrow the funds from another bank on the overnight market. Since Jupiter needs to pay for the funds that they borrow, we will assume that they borrow the smallest amount that they need, or $9,950. These loans between banks are for terms as short as one night, and banks like Jupiter who are borrowing pay the federal funds rate (or close to it) for this money. Before the COVID-19 pandemic in 2020, the federal funds rate was just below 1.6%, very near to the interest on reserves rate. After the pandemic caused a lot of problems with the economy, the Fed lowered this interbank loan rate to between 0.00% and 0.25%. This interbank loan shows up as a liability to Jupiter, and it is worth noting that it costs them less than deposits (recall we set the rate paid to deposits at 1% here). Jupiter’s borrowing can be seen in the new balance sheet in Table 2.20, which has grown by the amount of the interbank loan. One feature of the federal funds rate market is that the loans are not collateralized, meaning the bank is borrowing reserves from another bank on the promise that the loan will be repaid. If banks cannot get a federal funds market loan, they are often able to post assets (like government securities) as collateral and borrow money at similar rates.

A key feature of the interbank loan market is that banks do not have to hold reserves against these funds. Thus, it is a way banks can meet their requirements without having to maintain additional reserves.

| Interbank Loan | $9,950 | ||

| Excess Reserves | $9,950 | ||

| Total | $9,950 | Total | $9,950 |

| Required Reserves | $0 | Deposits | $10,050 |

| Excess Reserves | $0 | Interbank Loan | $9,950 |

| Securities | $20,000 | ||

| Loans | $50,000 | Capital | $50,000 |

| Total | $70,000 | Total | $70,000 |

As long as there are excess reserves somewhere in the system, and other banks believe the borrowing bank is likely to repay, banks have access to necessary funds. If there is a shortfall in reserves—because many banks are trying to borrow—the Fed can “inject” liquidity into the system by creating reserves which they can use to temporarily purchase assets like Treasuries from a bank or the general public. They would do this open-market purchase when they observe the federal funds rate—the overnight cost of borrowing—is rising above their preferred target federal funds rate. The target federal funds rate along with the interest rate on reserves are the most important interest rates set by the Federal Open Market Committee during their meetings, which occur every six weeks.9 The Federal Reserve Open Market Desk purchases securities from the banking system or general public, using reserves that it creates out of thin air. These reserves are usually electronic, but the Fed can direct the Treasury to print paper currency that could also be used as reserves. We assume here in Table 2.21 and 2.22 that the Fed buys $10,000 of bonds directly from Jupiter—even if this is an unlikely real-world scenario.10

In this scenario the Fed is fulfilling its role as the lender of last resort and ultimate source of liquidity to the system. If the system is illiquid then the creation of credit for borrowers like Olivia might slow down more than anticipated. Credit plays a very important role in our economy, as it helps finance firm operations, and helps smooth consumption by households who otherwise receive lumpy payments.

| Securities | -$10,000 | ||

| Excess Reserves | $10,000 | ||

| Total | $0 | Total | $0 |

| Required Reserves | $0 | Deposits | $10,050 |

| Excess Reserves | $10,000 | Interbank Loan | $9,950 |

| Securities | $10,000 | ||

| Loans | $50,000 | Capital | $50,000 |

| Total | $72,005 | Total | $72,005 |

2.7 Binding Constraints and Bankruptcy

Following the Fed’s purchase of bonds from Jupiter, we observe that Jupiter can make more loans and still meet its capital and reserve requirements. With $50,000 in capital, they can make up to $500,000 in loans, since $50,000 is 10% of $500,000 and 10% is our capital requirement. Also, with $10,000 in reserves, they would be able to have an infinite amount of deposits—since 0% is our technical reserve requirement. This does not mean they want to make an infinite amount of loans, just that they are not currently constrained by either requirement. Also note that since Jupiter has access to the overnight market for reserves that they could increase lending and borrow the reserves necessary to meet any requirement. It is worth reiterating that the job of Jupiter bank is to make a profit, and holding onto reserves only earns the interest on reserves rate of 0.1% paid by the Fed. Let’s next presume that the managers of Jupiter target a level of $150,000 in loans, which are made to customers who redeposit their money back into the bank. Jupiter’s balance sheet is now shown in Table 2.23.

| Required Reserves | $0 | Deposits | $120,050 |

| Excess Reserves | $12,050 | Interbank Loan | $1,955 |

| Securities | $10,000 | ||

| Loans | $150,000 | Capital | $50,000 |

| Total | $172,005 | Total | $172,005 |

To reach the target level of loans of $150,000, Jupiter would have had to have made $100,000 in additional loans. This is 10-times the excess reserves in Table 2.22. With these additional loans, let’s see if the bank is meeting its capital and reserve requirements. The bank has exactly 10% of its deposits held as reserves, so it is meeting that requirement since it is above $0. As for capital, the bank has $150,000 in loans, and needs to have 10% (or $15,000) in capital. The bank has $50,000, well over $15,000 in capital required, so the bank is also meeting its capital requirement.

Recall that the act of a bank lending comes with a degree of risk, the risk being that the borrower will not repay the loan. Thus, when banks lend people money to buy homes, they usually require the purchaser to post the house as collateral to the loan as well as put a cash “down payment” towards the purchase price. Historically, this down payment was 20% of the purchase price, so a $100,000 apartment would require the buyer pay $20,000 in cash up front. The bank would provide the other $80,000 in the form of a mortgage. If the borrower loses their job or cannot come up with their mortgage payments, they are foreclosed on by the bank. In foreclosure, the bank seizes the apartment and can resell it to recoup their losses. Since banks do not typically like to own homes, they will often try to sell these homes as fast as possible, likely selling it for less than it might otherwise be worth. In this situation, the bank would face losses on the value of their assets, since they write-down or reduce the value of their loan portfolio.

In Table 2.24, we presume that Jupiter faces losses of $10,000 on its loans. This might be because the bank lent a client money who ran up a balance on a credit card which they were unable repay and went into bankruptcy. In our balance sheet in Table 2.25, Jupiter’s loans and capital decline together. The bank still owes its depositors their money back, and their reserves are not available to reflect losses. The owners of the bank suffer these losses, and the bank’s overall balance sheet shrinks.

| Loans | -$10,000 | Capital | -$10,000 |

| Total | -$10,000 | Total | -$10,000 |

| Required Reserves | $0 | Deposits | $120,050 |

| Excess Reserves | $12,050 | Interbank Loan | $1,955 |

| Securities | $10,000 | ||

| Loans | $140,000 | Capital | $40,000 |

| Total | $162,005 | Total | $162,005 |

Taking this a step further, now assume that Jupiter has made a lot of bad loans, so many in fact that they lose another $45,000 in value (Table 2.26). The new balance sheet would show a negative value for net worth in Table 2.27. At this point, Jupiter is insolvent, meaning it cannot liquidate its assets and repay its creditors. The Federal Deposit Insurance Corporation (FDIC) exists to intervene in these circumstances. The FDIC makes depositors whole and makes up for the shortfall in capital at a loss to the FDIC insurance fund. Banks like Jupiter are members of the FDIC and pay periodic insurance premiums to help ensure the solvency of the banking system.

The FDIC usually tries to intervene well before the bank is insolvent, and usually tries to help arrange for another firm to buy the failing firm. Another bank might want to buy access to Jupiter’s depositors, their remaining loan portfolio, or the physical locations and employees.

| Loans | -$45,000 | Capital | -$45,000 |

| Total | -$45,000 | Total | -$45,000 |

| Required Reserves | $0 | Deposits | $120,050 |

| Excess Reserves | $12,005 | Interbank Loan | $1,955 |

| Securities | $10,000 | ||

| Loans | $95,000 | Capital | -$5,000 |

| Total | $117,005 | Total | $117,005 |

2.8 Capital v. Reserve Constrained Banking

Regulation of both capital and liquidity play an important role in banking. Here we examine another fictional bank—Callisto Bank—to discuss the role for regulation. First, we examine the debt-to-equity ratio, which is calculated as the total amount of liabilities—or debt—to the total amount of capital. In Table 2.28, Callisto Bank has a debt-to-equity ratio of $210,000 to $15,000, which is 14-to-1. This is also sometimes referred to as the banks’ leverage ratio, since it represents the amount of borrowed money that the bank is using relative to their own capital. Highly leveraged banks are taking more risk, since if the bank’s assets decline in value, the losses are amplified by this amount. Next, a capital ratio is found by taking the total of all risky loans, $120,000, and comparing that to total capital of $15,000, yielding an 8-to-1 ratio.11 This is the same thing as having 12.5% of loans held as capital. If we continue using the 10% requirement from earlier, then this bank is meeting its capital requirement. With $200,000 in deposits, and $30,000 in total reserves, the bank is also well above its reserve requirement with a 15% ratio.

| Required Reserves | $0 | Deposits | $200,000 |

| Excess Reserves | $30,000 | Interbank Loan | $10,000 |

| Securities | $75,000 | ||

| Loans | $120,000 | Capital | $15,000 |

| Total | $225,000 | Total | $225,000 |

So, our question is to see how much lending this bank could do and still meet both statutory requirements. With existing reserves, the bank could support an infinite amount of deposits, since $30,000 of reserves could support any size of deposits (Table 2.29). If we added a $100,000 loan here, the new balance sheet would have an increase of $100,000 on each side since the $30,000 of excess reserves would still be on hand after the increase in deposits.12

If we check the capital requirement, we will see that the bank is holding loans that place it at more risk than regulators would prefer. Callisto’s capital ratio is only at 6.8% ($15,000/$220,000), below its 10% requirement of $22,000. Callisto should not be making loans in this amount. In this case, we say they are capital constrained but not liquidity constrained. If Callisto wanted to increase lending while still meeting their capital requirement, they could increase lending from $120,000 in Table 2.30 to $150,000 (which is $15,000 divided by the capital requirement of 10%). The balance sheet would grow by $30,000. Banks like Callisto might be able to borrow more reserves on the overnight market and increase their lending by much more than the amounts mentioned here. Banks face other regulations, but the role played by capital is very important to understanding the financial crisis in the late 2000s.

| Required Reserves | $0 | Deposits | $300,000 |

| Excess Reserves | $30,000 | Interbank Loan | $10,000 |

| Securities | $75,000 | ||

| Loans | $220,000 | Capital | $15,000 |

| Total | $325,000 | Total | $325,000 |

Table 2.30 is more representative of the modern system, where banking operations are more constrained by access to capital and capital requirements than reserve or liquidity requirements. After the 2008 Financial Crisis, the Federal Reserve increased reserves in the system by nearly $4 trillion. This increase spurred fears of an overwhelming increase in lending, but those predictions failed to understand that banks were already constrained by capital requirements and a lack of demand for new lending. Following the housing crisis which started in 2006, bank capital had been decimated. Banks were not necessarily eager to go out and make lots of new loans just because they were given the reserves to do so. Instead, they faced much tighter oversight of their capital when many banks were facing a crisis of solvency. The Fed can only do so much when banks face solvency issues, since that is left to the FDIC who does not typically help recapitalize banks. Banks were left to raise capital on their own and were under pressure to find investors who would be willing to give banks money in exchange for ownership stakes in now undercapitalized banks. In 2008, the Troubled Asset Relief Program or TARP authorized the government purchase of an ownership stake in financial institutions that were deemed systemically important. These institutions were effectively nationalized as the government took a large controlling stake in the banks. The government did not overwhelmingly restrict the banking operations of these institutions, although TARP did come with some additional oversight responsibility.

| Required Reserves | $0 | Deposits | $230,000 |

| Excess Reserves | $30,000 | Interbank Loan | $10,000 |

| Securities | $75,000 | ||

| Loans | $150,000 | Capital | $15,000 |

| Total | $255,000 | Total | $255,000 |

2.9 Federal Reserve Tools/Instruments, Targets, and Goals

There is a distinction between the Federal Reserve’s tools (or instruments), targets, and goals. The main tools used by the Federal Reserve are the:

- Open Market Operations: The Fed’s purchase (sale) of bonds intended to decrease (increase) the federal funds rate. These operations are done multiple times per day with the intention of trying to maintain the Fed’s target federal funds rate.

- Interest on Reserves: Starting in October 2008, the Fed began paying banks for holding reserves. There are separate rates paid for required and excess reserves (although they have been set equal to each other since the program’s inception). Since 2008, this rate has been used to help guide the federal funds target rate.

- Reserve Requirements: The percentage of deposits that must be held in the form of the bank’s reserves.

- Balance Sheet Operations: When the Fed increases the size (quantitative) or quality (qualitative) of its own balance sheet. This can be used to try and influence interest rates other than the federal funds rate.

- Discount Rate: The cost of borrowing reserves directly from the Federal Reserve. This is nearly identical to how the interbank loans work, except the reserves are coming from outside the private sector and the loans are collateralized. There is also an increase in reserves through a discount rate loan.

The Fed’s targets are the intermediate things the Fed is trying to change which might influence economic activity like consumption or investment. Some examples of targets are the:

- Federal Funds Rate: The Fed sets a target rate in this market by providing sufficient liquidity to push lending conditions towards their preferable state. This interest rate is now guided by the interest on reserves rate which is set to be close to the target fed funds rate. Increases (decreases) to these interest rates are expected to indirectly cause other interest rates to rise throughout the economy, including Treasury and riskier assets.

- Long-term Interest Rates: The Fed might choose to also try to manipulate longer-term interest rates to affect behavior in other markets.

- Money Supply: The Fed could try to target the total supply of money, in the form of deposits and currency (i.e., M1) or the broader M2 money supply (M1+MMMF+Savings+Time deposits).13

Ultimately, the Federal Reserve is trying to reach its goals of:

- Full Employment: interpreted as unemployment at or near the natural rate of unemployment

- Stable Prices: interpreted as a stable and low rate of inflation at or near 2%.

The Fed is free to change its instruments, and form its own targets, but the goals are more rigid since they are mandated by Congress. By law, the Fed’s job is to maintain full employment and stable prices, but they are free to interpret what this means. So, there is some flexibility here, where rather than focus on keeping prices constant they have chosen to instead try to keep inflation steady (which is the rate of change in prices).

2.10 An Aside on Money Supply

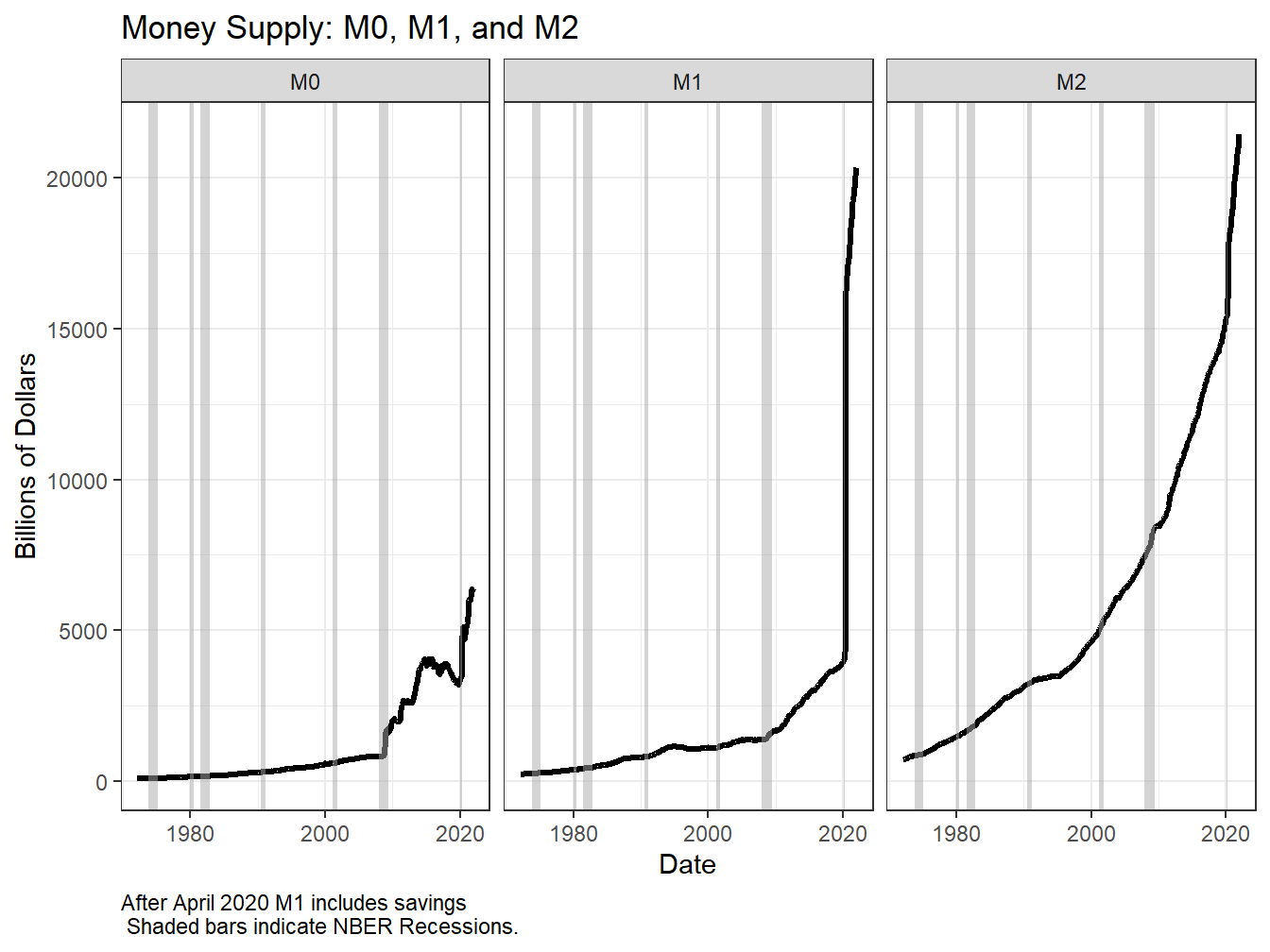

At times in the past, the supply of money has been debated as an important measure to focus on. In recent years though central banks like the Federal Reserve and European Central Bank have let it be known that the supply of money is not as important as it was once thought to be. This does not mean that pundits and journalists do not emphasize it though, and it often arises in popular media. In early 2020, you can see one measure of the money supply rises very rapidly (Figure 2.3). Many people directly attribute this to some response by the Federal Reserve, however the story is a bit more nuanced.

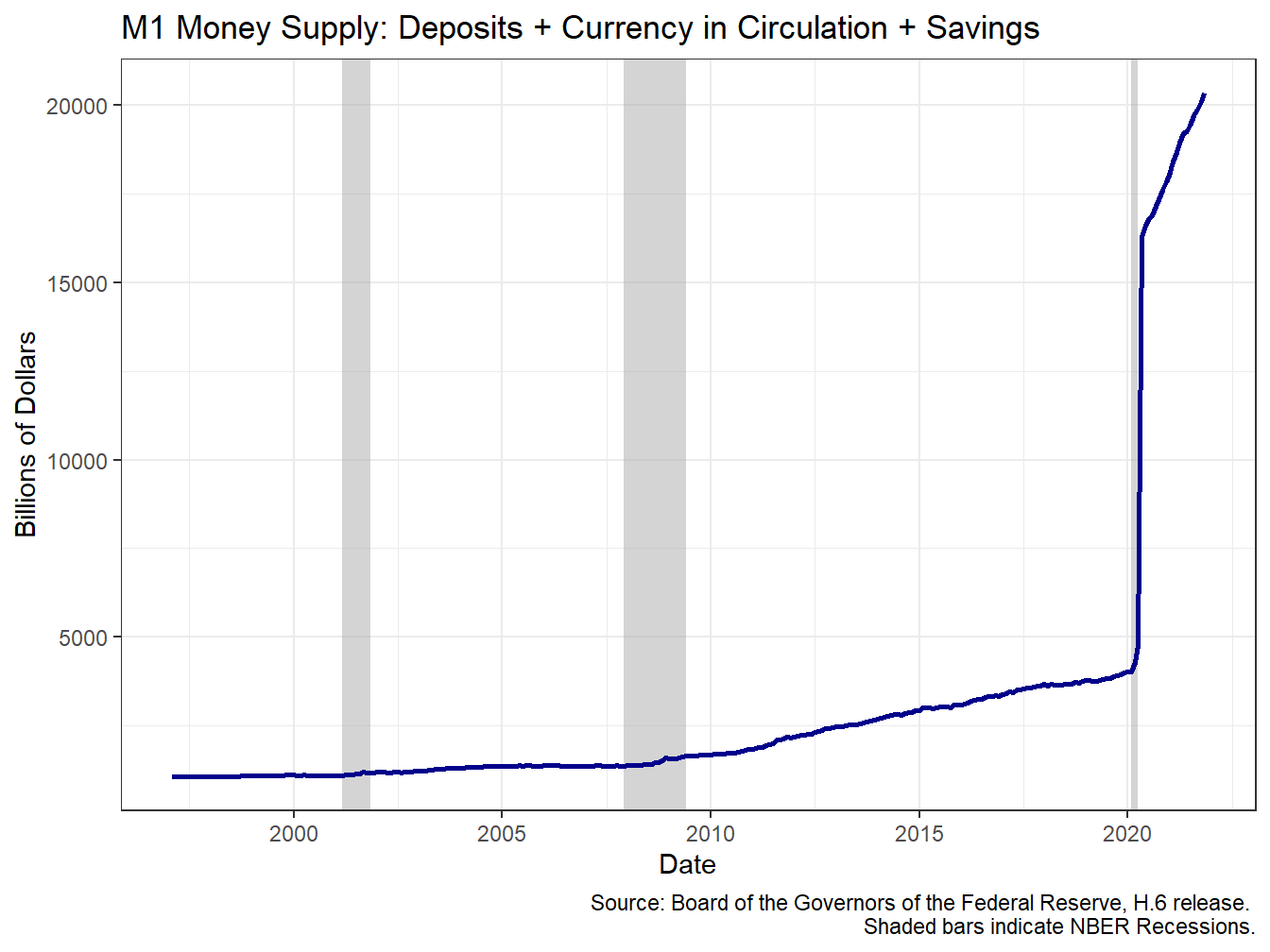

Figure 2.1: The M1 Money Supply Has Grown Over Time

The measure of money we are observing in Figure 2.1 is known as M1. M1 is known as the most liquid form of money. If you look up a definition of M1 in most textbooks or on the internet, you will see it has long been defined as seen in equation (2.1), which I will call Old M1.

\[\begin{equation} \text{Old } M1 = \text{Currency in circulation} + \text{Deposits} \tag{2.1} \end{equation}\]

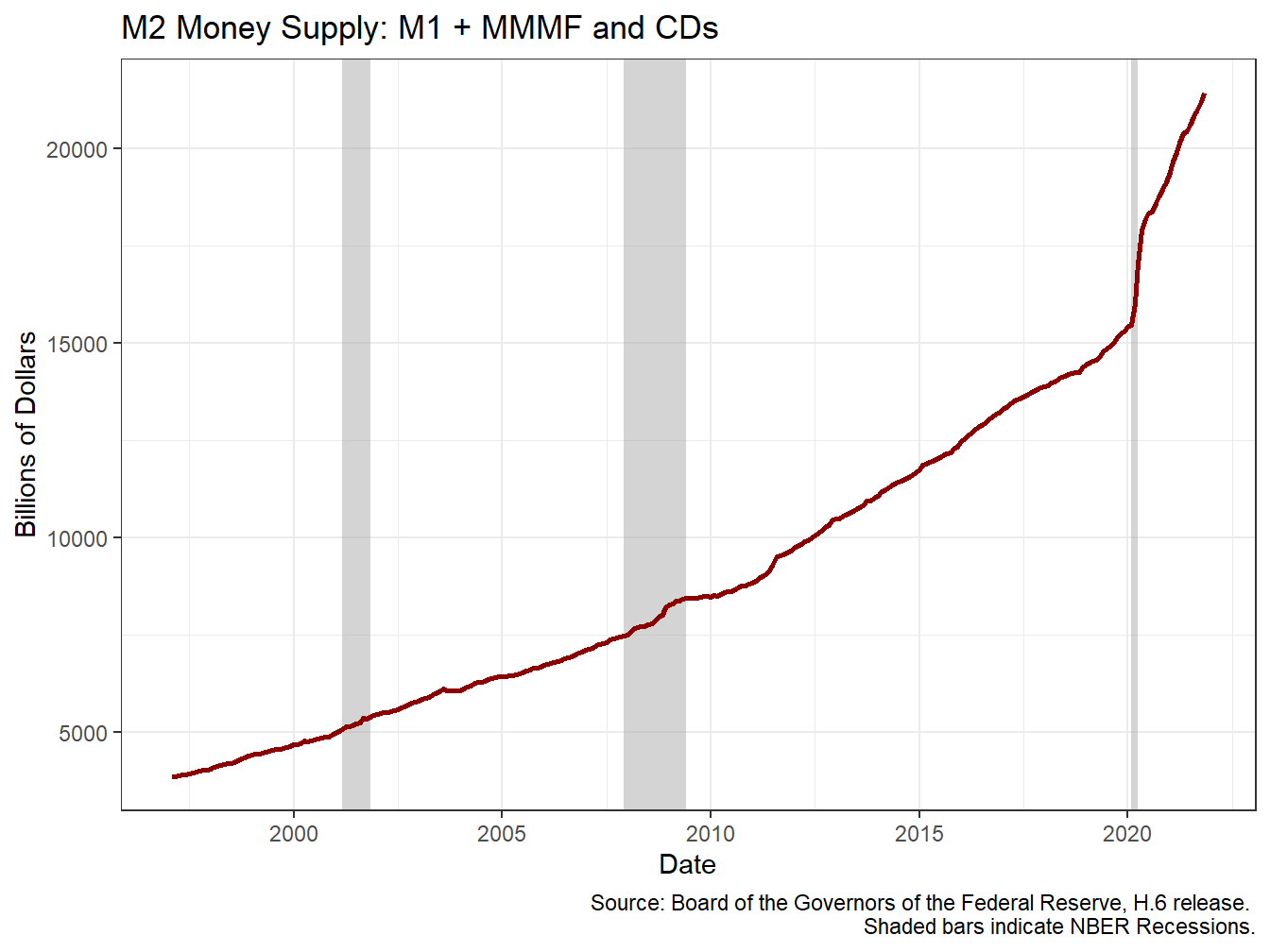

A broader measure of the money supply known as M2 was long defined as seen in equation (2.2)—or Old M2—and displayed in 2.2. You might note that there is an increase in both M1 and M2 in 2020 during the COVID-19 pandemic, but the increase in M2 is much less pronounced.

\[\begin{equation} \text{Old } M2 = M1 + \text{MMMF} + \text{Savings Deposits} + \text{CDs} \tag{2.2} \end{equation}\]

The components of M2 here include all of M1, as well as: money market mutual funds (MMMF)—similar to checking accounts with some restrictions on the ability to withdraw your money; Certificates of deposit (CDs)—also known as small-time deposits typically face a penalty for early withdrawal; and savings deposits, which are often linked to checking accounts and had long had many restrictions on the ability to access your money. Savings accounts are the most important thing to focus on here. The main difference between M1 and M2 here is that there was a technical change in what counted as M1 and M2. As mentioned above, M1 had been defined as in (2.1), but in March 2020 the Fed eliminated certain restrictions on moving money in and out of savings accounts, thus making them more liquid. The Fed therefore reclassified savings to be part of M1. Importantly, this change does not impact the size of M2.

Figure 2.2: The M2 Money Supply Has Also Grown

The new form of M1 is now:

\[\begin{equation} M1 = \text{Currency in circulation} + \text{Deposits} + \text{Savings Deposits} \tag{2.3} \end{equation}\]

while M2 is the same since savings moved into M1, which is part of M2.

\[\begin{equation} M2 = M1 + \text{MMMF} + \text{Certificate of Deposits} \tag{2.4} \end{equation}\]

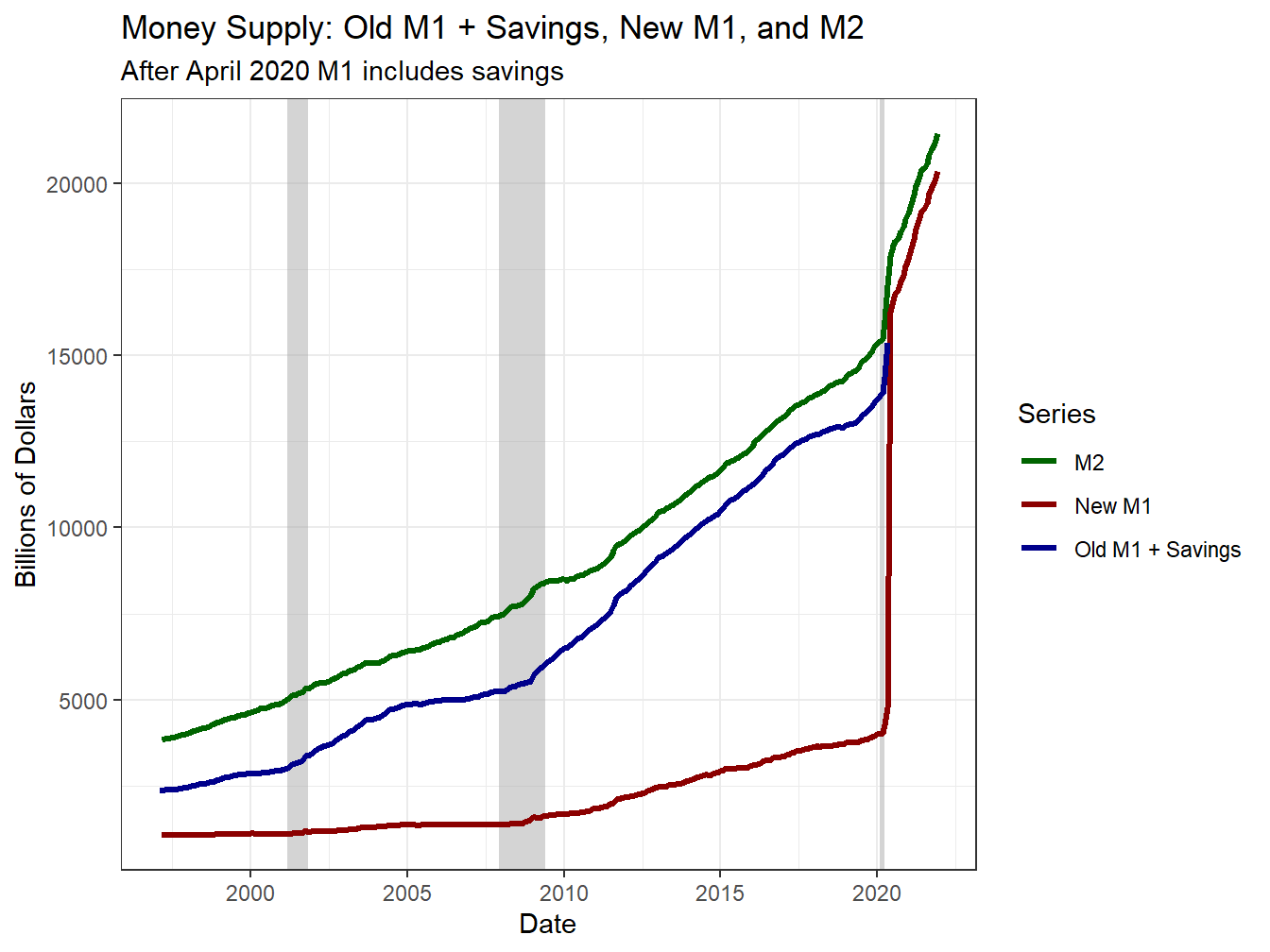

Figure 2.3: The Money Supply Has Also Changed Over Time

When plotted together, we can see that if we include savings account balances in the old M1 definition, that it tracks very closely with M2 until April 2020. Thus, while there are big changes in the COVID-19 pandemic to the various monetary aggregates, the increase in M1 is far less suspicious than some pundits might lead you to believe. The New M1 series provided by the Fed did not go back and add in savings as I have done here. However, you might now notice that including that aggregate matters for the overall discussion.

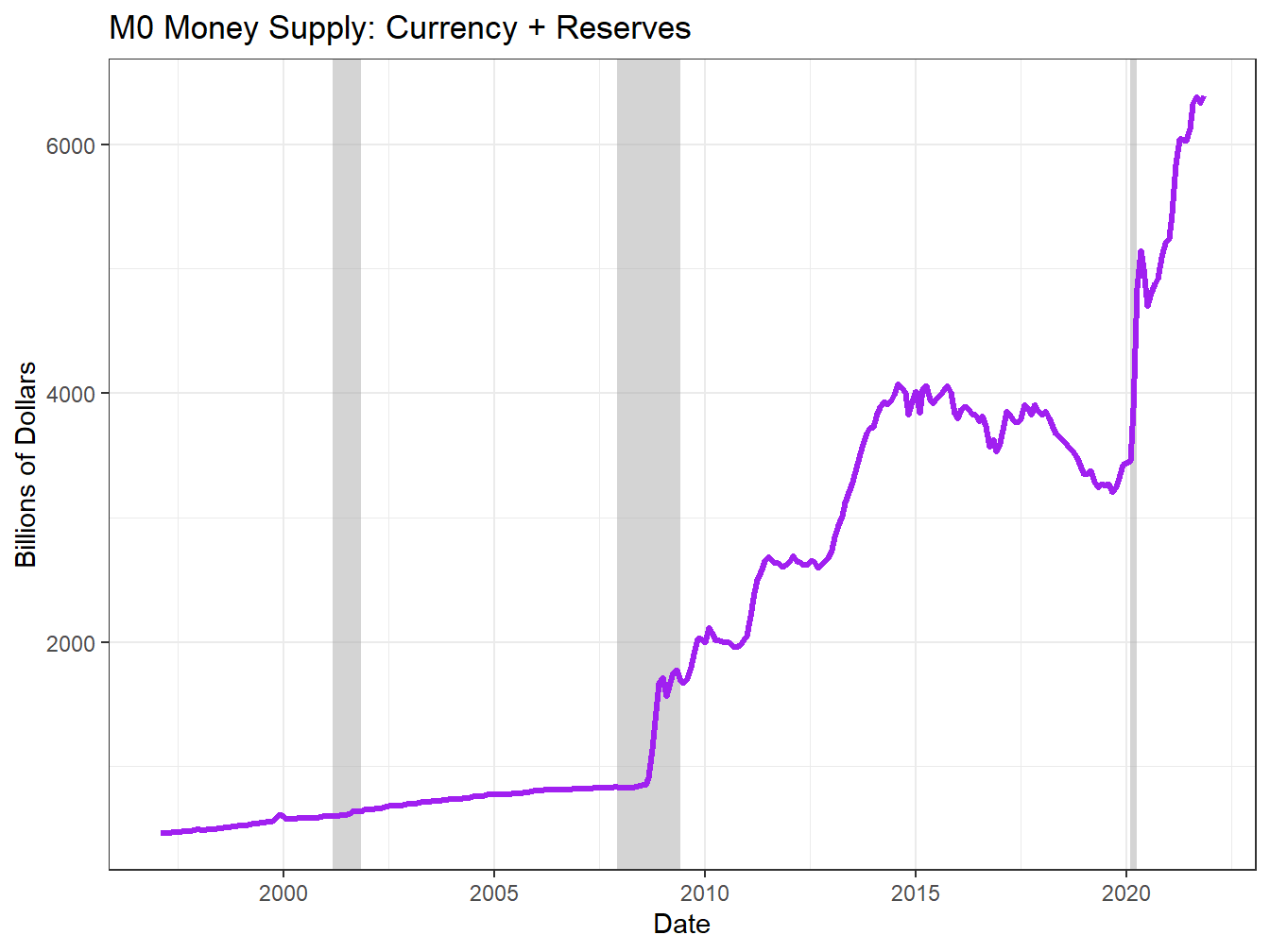

With all that said, there is still a big jump in M2 in 2020, and this is due to Fed actions to help rescue the economy during the pandemic. We can see this in another measure of money supply known as the monetary base or M0. Another term to describe M0 is outside money which somewhat confusingly means money created outside the private banking sector. We calculate M0 as:

\[\begin{equation} M0 = \text{Currency in circulation} + \text{Reserves} \tag{2.5} \end{equation}\]

Seen below in 2.4 the monetary base climbed steadily until about 2008 when the U.S. encountered the financial crisis related to the bust in the housing market and fallout. The consequences of this crisis were so severe, that the Fed was working to help stimulate the economy and aid the financial system for years to fully recover. Only in the few years prior to 2020 was the monetary base beginning to decline. While some might look at this chart and note that the money supply is rising seemingly without bound, this value of M0 reflects the central bank’s efforts to help banks remain liquid throughout a period of crisis.

Figure 2.4: The Monetary Base Grew During Crises

Side-by-side and going back a bit further in time in Figure 2.5, we can see that there had been a steady increase in M0 and M2 over time, with the 2008 financial crisis being associated with a big change in these aggregates. The next big change occured in 2020 during the COVID-19 pandemic. In the coming chapters, we will discuss the Fed’s role a bit more.

Figure 2.5: Side by Side of Monetary Aggregates

Real variables would include things that can be measured objectively, like hiring someone to mow my lawn. The labor it takes to mow the lawn is real, as is the machine (i.e., physical capital) used to cut the lawn. The amount of a given currency paid to the worker or to buy the mower is a nominal variable since it is just representing relative value.↩︎

Social and political norms can help arbitrate the renegotiation under certain circumstances like death. Suppose a person owes their bank $1,000, but passes away suddenly. The bank might try to recoup their losses by taking over ownership of the person’s house or car.↩︎

Note that each of these are flow variables and are comparable since they are measured over the same length of time.↩︎

For the ease of exposition, interest payments have been combined with all other expenses, and the $50 per month represents principal repayment.↩︎

T-accounts are the flow counterpart of balance sheets, and themselves must balance. When combining a T-account with a starting balance sheet, the changes shown in a T-account will lead you to the updated balance sheet.↩︎

The $3,000 is the principal on the loan, the 5% represents the interest rate, and the four years represents the term to maturity. The $77.50 figure is found by using an amortization calculator like those found at https://www.amortization-calc.com/loan-calculator/.↩︎

Since the reserve requirement is zero, all reserves are considered excess.↩︎

The Federal Reserve (Fed) pays banks interest on reserves. The Fed creates reserves—out of thin air—to pay to private banks for their reserve balances.↩︎

The FOMC can decide to change rates in between meetings, but this is rare and usually only in response to very severe shocks. The last time the FOMC changed interest rates in between meetings was in early 2008.↩︎

Notice that the Fed is effectively using newly created money to bid up the price of bonds that are for sale on the open market. This would lead to an increase in the price, and a decline in the interest rate. In our example here, this is what the Fed is trying to accomplish. When interest rates are rising away from the Fed’s target federal funds rate, they inject liquidity to ease the upward pressure. If interest rates are falling below their target, their goal is to extract liquidity, lowering prices and raising interest rates.↩︎

We are assuming here that the debt issued by the bank only takes the form of loans, and equity only comes in the form of capital.↩︎

Note again, we are assuming all loans created are immediately held as deposits.↩︎

Savings accounts or money-market deposit accounts (MMDA) are less liquid than checking. Money market mutual funds (MMMF) are another less-liquid alternative to deposits. Finally, small-denominated time deposits-or certificate of deposit (CDs)-are investments that can be liquidated with a small penalty.↩︎